The hybrid planning application will see two existing warehouse buildings demolished and replaced with two residential towers delivering co-living and affordable housing alongside community and education facilities.

The development has been designed architect Squire & Partners for site owner Pirin Limited and its development partner Fifth State.

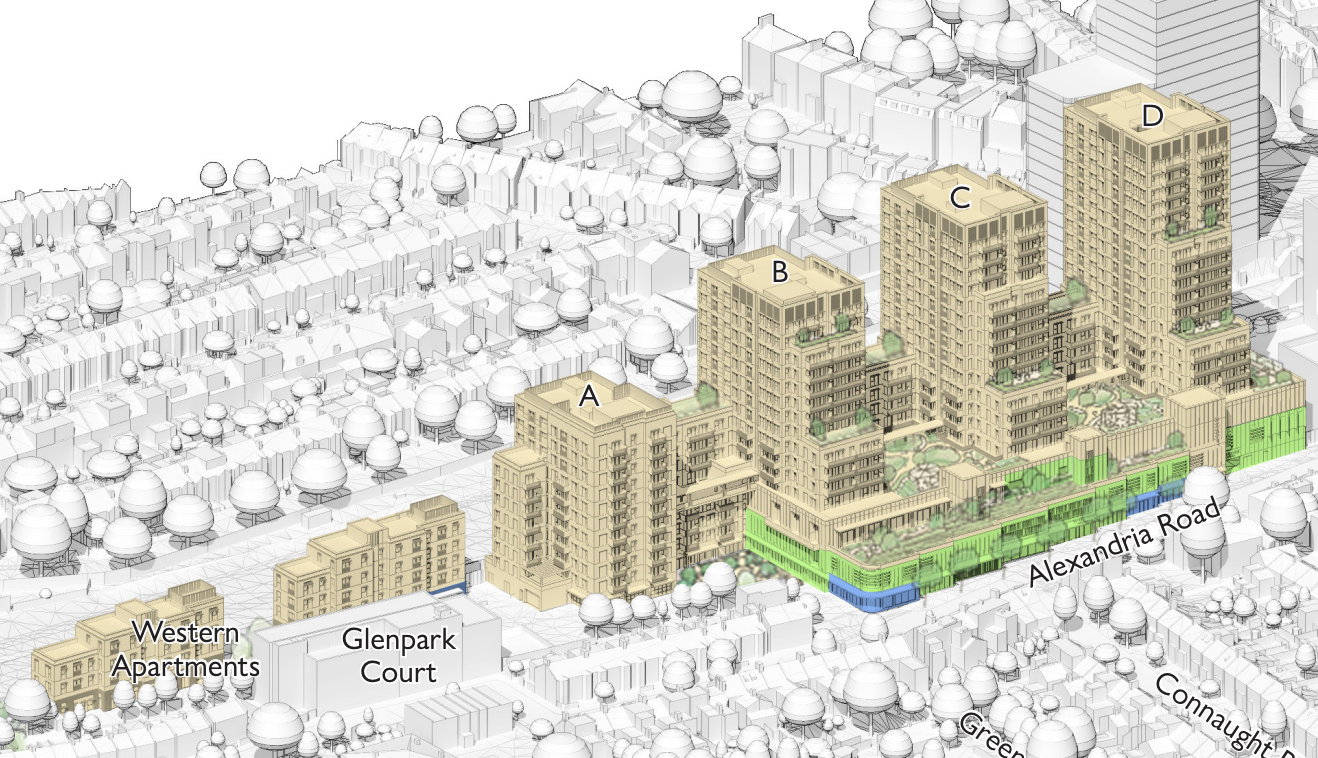

The centrepiece of the scheme is a 42-storey tower containing 843 purpose-built shared living units aimed at young professionals and key workers.

Next to it, a 27-storey tower will provide 153 affordable homes, delivering 42% affordable housing across the development.

Of these homes, 121 will be low-cost rented properties and 32 will be intermediate homes. Around two-thirds of the rented homes will contain three or four bedrooms aimed at families.

At ground level the affordable housing block will include a 161 sq m community hub facing onto a new 1,500 sq m public park located in the south-west corner of the site.

The hybrid application also includes outline plans for a new alternative provision school for up to 100 pupils in the north-west corner of the site. The facility could deliver up to 4,510 sq m of education floorspace.

Both towers will feature terracotta-coloured metallic aluminium cladding. A darker shade will be used on the co-living tower referencing nearby railway infrastructure, while a lighter tone will be used on the affordable housing building.

Developers said the scheme will transform an under-utilised brownfield site while helping deliver new homes and community facilities in the Isle of Dogs Opportunity Area.