£120m scheme approved for London School of Economics

Posted on March 20th, 2015 by admin

Westminster City Council has given the green light to the largest London School of Economics development project in its 120 year history.

The £120m Centre Buildings Redevelopment project is designed to create a new focus for the central London campus.

It will involve constructing 200,000 sq ft of academic buildings rising up to 14-storeys arranged around a public square.

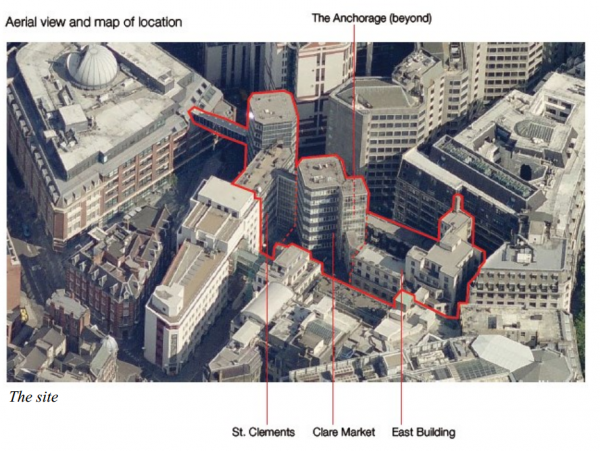

The redevelopment involves the demolition of the existing LSE owned buildings along Houghton Street, known as Clare Market, The Anchorage, the East Building and part of St Clements.

Demolition is due to begin at the start of this year’s summer break with the building due to be completed in late 2018.

The contest for a main contractor will start shortly to appoint a firm early next year.

Director of Estates Julian Robinson said: “This is a major milestone in our ambitious programme of improving facilities and accommodation at LSE. We are a world class university and the Centre Buildings Redevelopment will provide a new building and public spaces which will reflect this. ”

Architects Rogers Stirk Harbour + Partners designed the project. Their team includes ChapmanBDSP as MEP consultants, AKTII as structural engineers and Gillespies as landscape architects. Turley are LSE’s planning consultants for the scheme with Deloitte as cost consultants.

Read MoreMcLaren swoops on £130m north London job

Posted on March 20th, 2015 by admin

Construction information specialist Glenigan confirmed McLaren as main contractor with Dunne Building & Civil Engineering due to carry out groundworks plus the foundations and frame.

United House Developments is the client in a joint venture with land owners the Business Design Centre.

United House’s own contracting arm was originally lined-up to deliver the scheme back in Spring 2013.

But the project start was delayed and United House construction suffered losses during the year to 2012 after an ill-fated foray into private sector work.

The construction division has since been merged with Bullock and refocused back on its traditional social housing market.

The City North scheme will see construction of of 308 one – four bedroom private apartments in two 21 storey buildings.

Works will also include 47 affordable homes and 10,776 sqm of retail, office, restaurant and leisure space.

New schemes at Kings Cross

Posted on March 17th, 2015 by admin

Argent development has named Kier preferred bidder for two contracts worth £130m at the King’s Cross Goods Yard development in London.

The two projects, currently badged R7 and R8, will provide a mixture of housing, retail, leisure and commercial office space.

Both schemes are due to start next year.

R7 (above) is a new development of 150,000 sq ft. Its West tower will have 13 storeys of offices above a cinema and retail units while the East tower will hold 11 storeys of offices above retail space at ground level.

R8 is a 200,000 sq ft scheme to construct a mixture of private and affordable housing together with office accommodation and retail space.

The contracts are the latest in a long line of projects that Kier is involved in at King’s Cross.

Kier is currently redeveloping the Grade II listed Midland Goods Shed and East Handyside Canopy for supermarket chain Waitrose with offices above for the Guardian Media Group.

Kier recently completed both the £42m ArtHouse scheme, a housing development providing 143 homes for the area; and 5 Pancras Square, the £65m public services hub for Camden Council, heralded as one of the greenest public buildings in the UK.

Haydn Mursell, Kier chief executive, said: “As the London market grows at pace, we are establishing ourselves as a delivery partner of choice on major projects, regeneration schemes and in high-rise development.

“We look forward to continuing to increase our presence in the market.”

Read MoreJP Morgan gives up on new HQ in Canary Wharf

Posted on March 16th, 2015 by admin

JP MORGAN is set to scale back its ambitions in London by selling a site in Canary Wharf once earmarked for a new £1.5bn headquarters.

The American investment bank is close to appointing agents to market Riverside South, where it has planning permission for two huge office towers designed by the architect Richard Rogers.

JP Morgan emerged from the financial crisis relatively unscathed but suffered a trading scandal and heavy fines over allegations of historic mortgage abuses. Like other Wall Street banks, it has felt the pinch of falling trading revenues.

It bought Riverside South from Canary Wharf two months after Lehman Brothers’ collapse in 2008 and is thought to have spent tens of millions of pounds getting the site ready for construction. The bank moved its staff into Lehman’s former docklands headquarters, 25 Bank Street, in 2010 but said it was still committed to building the statement headquarters.

Source: Sunday Times

Read MoreCarbon monoxide and smoke alarms to become law for landlords

Posted on March 14th, 2015 by admin

New measures announced by housing minister Brandon Lewis require that landlords must now by law install working smoke and carbon monoxide alarms in their rental properties.

The move has received strong support and is expected to come into effect in October 2015. The government claims that the new measure will help to prevent up to 36 deaths and 1,375 injuries every year.

Support will be provided by England’s fire and rescue authorities in their own areas, with government funding and free alarms available. The suggested changes to the law would include landlords being required to install regularly tested smoke alarms on each floor of their property. Carbon monoxide alarms would also need to be installed in high risk rooms such as where a solid fuel heating system is installed. These devices would need to be checked prior to each new tenancy.

Failure to follow these guidelines would lead to a £5,000 civil penalty.

Lewis said: ‘In 1988 just 8% of homes had a smoke alarm installed – now it’s over 90%. The vast majority of landlords offer a good service and have installed smoke alarms in their homes, but I’m changing the law to ensure every tenant can be given this important protection. But with working smoke alarms providing the vital seconds needed to escape a fire, I urge all tenants to make sure they regularly test their alarms to ensure they work when it counts. Testing regularly remains the tenant’s responsibility.’

New London tower deal for stalled Pinnacle site

Posted on February 20th, 2015 by admin

Investor Axa Real Estate and developer Stuart Lipton have struck a deal to take over the Pinnacle skyscraper site in the City of London.

The pair, together with Asian investors, are reported to have bought the 22-24 Bishopsgate site for £220m and now plan to build a simplified tower design that will be the tallest in the city.

WSP has been signed up as the structural and building services consultant with architect PLP working on the design.

The firm was also structural engineer behind the Shard and New York’s Freedom Tower.

Contractor Brookfield Multiplex was forced to abandon construction of the Pinnacle tower in early 2012 after the core reached seven storeys when funding dried up.

The complex helter-skelter design, with customised curved curtain walling, will be dumped in favour of a streamlined, more cost-effective tower.

This will involve demolishing the existing concrete core, which led to the site being nicknamed The Stump, to clear the way for a fresh start.

Early working designs purporting to be for the new 60-storey tower have been released on the Skyscraper City internet forum, where they have been criticised for lacking the striking architectural presence of the previous Pinnacle scheme.

Fresh tower design for 22 Bishopsgate site

Plans will be submitted to the City Corporation planning authorities later this year with the aim of completing the new tower by 2018. The backers hope to start construction before the end of 2015.

Read MoreGo-ahead for Canary Wharf 28-floor curving tower

Posted on February 4th, 2015 by admin

Plans to build a 28-floor sloping office tower on one of the last remaining sites on the Canary Wharf estate have got the final thumbs up.

The London borough of Tower Hamlets’ planning committee has granted consent for the 146m high building, which will be located at One Bank Street at Heron Quays West.

The distinctive building has been designed by KPF, with a view to signing up two major tenants.

Outline plans were approved by Tower Hamlets back in April for the site. The detailed plan contains an atrium giving the office design a wider skirt on the lower floors and roof terrace.

Adamson Associates, acting as executive architect, is leading a full consultant team, which includes Arup as structural engineer and Hilson Moran the mechanical engineer.

French bank Société Générale has signed a 25-year lease for the building’s eight bottom floors, which cover a total of 280,000 sq ft.

The Heron Quays West site was previously earmarked for a three building scheme, with the highest tower being 33 storeys.

This has been revised to two major buildings of a lower height.

A similar height office block is planned for the adjacent 10 Bank Street, on Heron Quays West. Enabling works have begun after it received full approval

Read MoreSpring start for new £2bn Covent Garden Market

Posted on February 3rd, 2015 by admin

Construction is set to start on the £2bn New Covent Garden Market site in central London this spring.

Transformation of the 57-acre site situated next to Vauxhall Cross in the Nine Elms regeneration zone is being led by joint venture development partners Vinci and St Modwen.

St Modwen gave an update on the scheme in its latest results released today.

The London Borough of Wandsworth resolved to grant planning permission for the scheme last year.

St Modwen said: “We are targeting to achieve unconditional status in the first half of 2015, with preparatory works starting on site shortly afterwards.”

St Modwen starts its financial year from November meaning a start date around May.

The multi-phase scheme will take 10 years to build and includes development of 550,000 sq ft of modern facilities to house the 200 businesses that make up the UK’s largest fruit, vegetable and flower market.

Construction work will be funded from the release of 20 acres of surplus land for a residential led mixed-use regeneration scheme.

Much of this will be built on a separate site joined by a 1km linear park. In total more than 3,000 new homes and 135,000 sq ft of new office space and 100,000 sq ft of retail and leisure will be built.

Vinci Construction UK has been earmarked to construct the new market, with other firms likely to be brought on board to build the later housing projects.

Read MoreGreen light for 53-storey London Docklands tower

Posted on February 2nd, 2015 by admin

Plans for a 53-storey residential-led tower at Meridian Gate on the Isle of Dogs have been given the green light.

Joint developers Meridian Property Holdings and LBS Properties commissioned architect Make to design the latest tower plan, which will consist of over 400 one, two and three-bed apartments.

The tower, approved by the London Borough of Tower Hamlets, will be built beside West India Docks and is one of several sites that form the Marsh Wall East masterplan area.

The apartments benefit from the combination of balconies, winter gardens and terraces, providing private external space and views of the capital.

Frank Filskow, Make partner and lead project architect, said: “Meridian Gate will be an exciting new addition to the Isle of Dogs and responds to the Councils aspirations within the developing South Quay Masterplan.

“The slender design maximises the opportunity to provide a significant new park for residents and the local community.”

Read MoreCanary Wharf resigned to Qatari takeover

Posted on January 28th, 2015 by admin

Canary Wharf owner Songbird is resigned to being taken over by the Qatar Investment Authority and Brookfield Property Partners.

Songbird Estates said the 350p per share offer still under-valued the company.

But the three major shareholders in Songbird are now understood to have accepted the offer while no rival bid has been forthcoming.

Winning backing from the trio of biggest shareholders means QIA and Brookfield would control 85% of the company.

Songbird is now recommending that remaining shareholders accept the offer or face being squeezed out of the company.

Read More